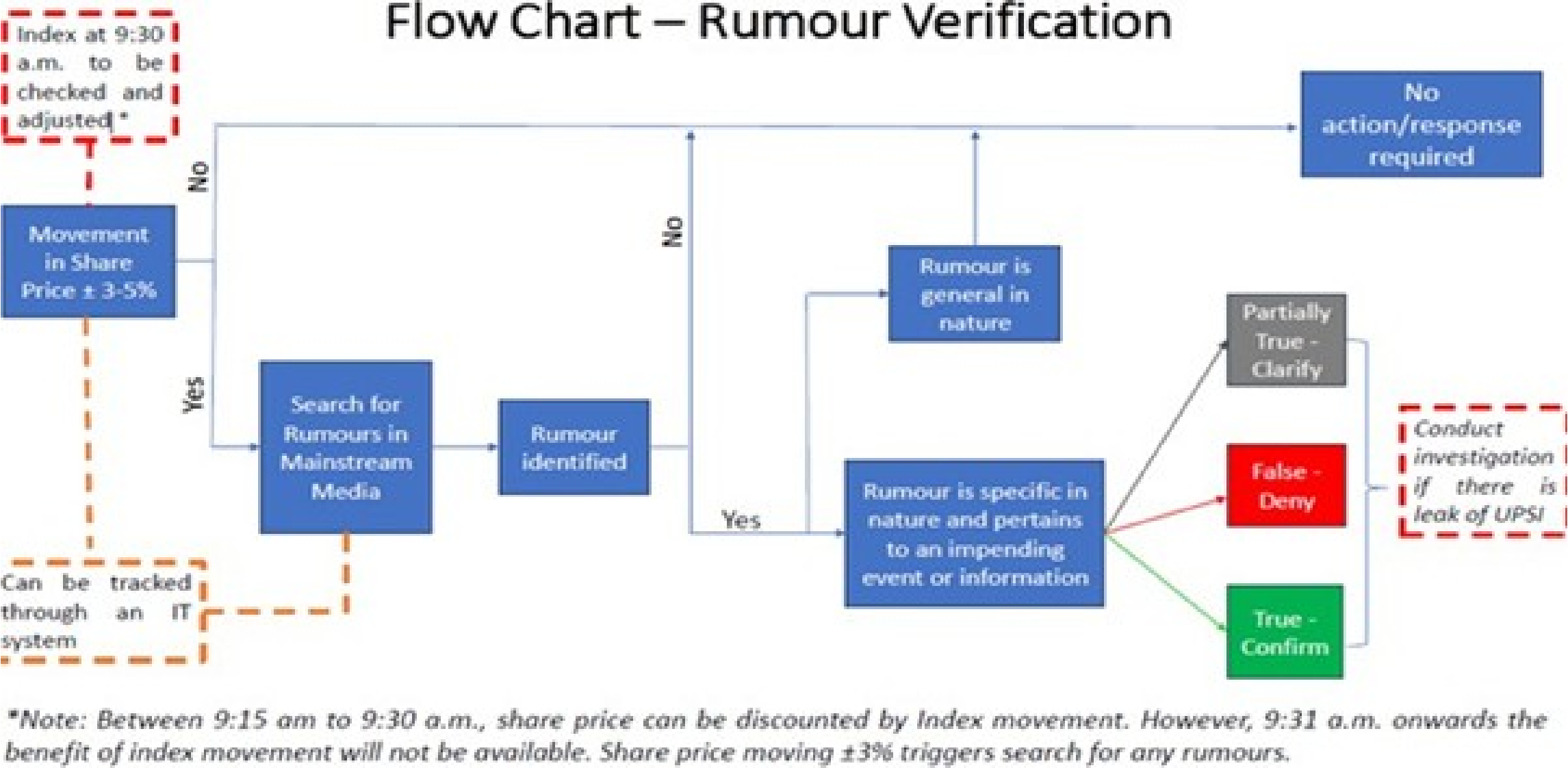

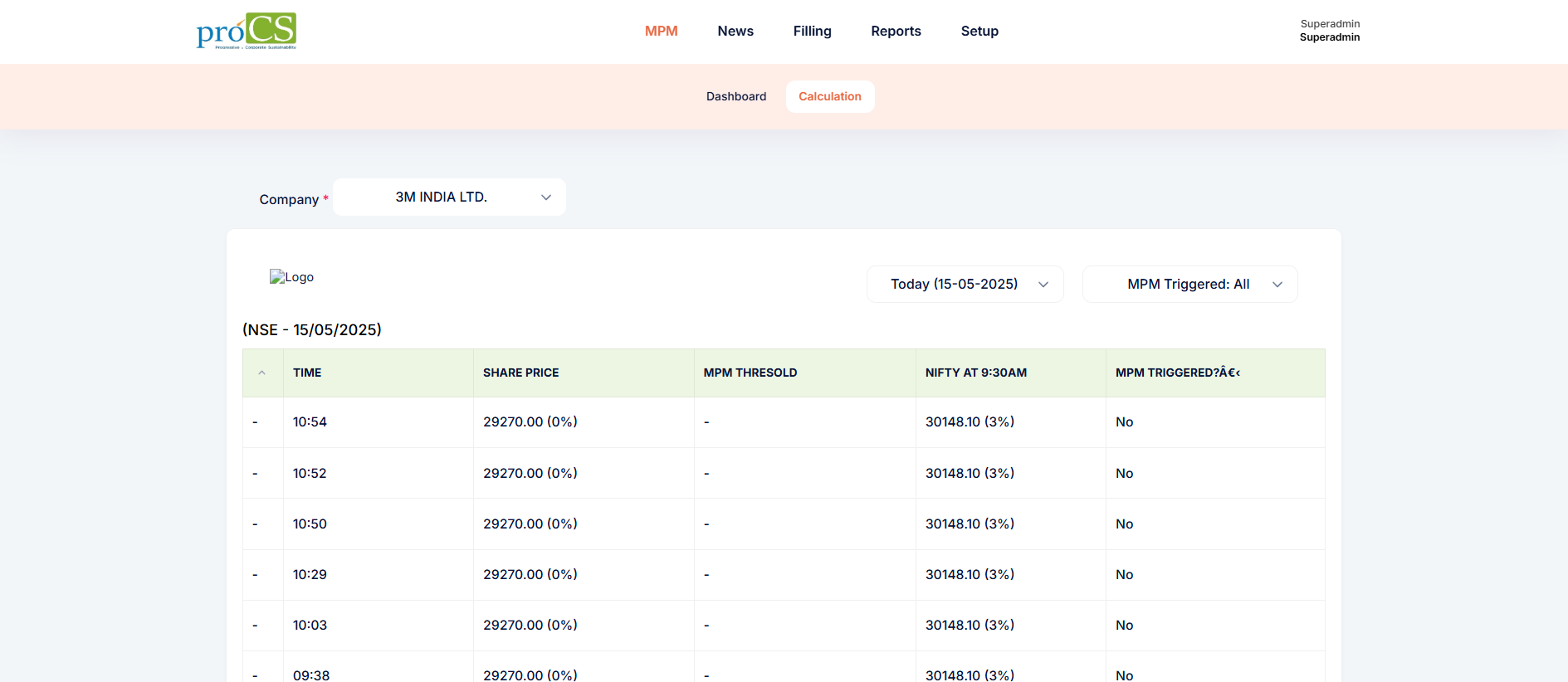

Material Price Movement Triggers

Automated tracking of MPM across exchanges (NSE/BSE). Alerts triggered by deviations beyond predefined thresholds. Notifications sent via:

Email: Detailed reports with price analytics.

WhatsApp/SMS: Instant alerts for executive decision-making.